The impact of risk management on company evaluation is significant as it directly influences various aspects of a company’s performance, resilience, and long-term viability. When companies prove they can handle risks effectively, it makes potential investors feel more secure and interested, improve financial performance, and mitigate potential losses, thereby positively influencing the company’s valuation and overall reputation in the market.

Besides, it enhances decision-making, reduces negative events, and increases reliability and resilience. It encourages openness and responsibility within the company, building trust among stakeholders and making the company more sustainable in the long run.

For companies, two essential aspects involve expertly identifying risks and maintaining a consistent set of risk management activities. Neglecting either of these areas can significantly impair overall business operations and evaluation. For instance, it can erode stakeholder trust, attract regulatory attention, and weaken competitiveness, all affecting evaluation negatively. How to avoid it?

Facing Risks

Various contexts present different types of risks, spanning financial, project management, health, and more. While some risks are common across industries, others are specific to industries. Identifying your areas of risk is the initial step that becomes an asset for better company evaluation.

Here are common risk areas to evaluate, along with some examples to relate. However, every company is unique, and it’s best to seek advice from experts who can prevent costly mistakes and maintain your business’s credibility in the eyes of investors.

Financial Risks

Market risk, credit risk, and liquidity risk are fundamental aspects of financial risk and are that goes first in company assessments. For example, an e-commerce startup facing liquidity and credit risks may encounter challenges such as limited access to capital and potential cash flow constraints.

Investors seek details of how a company mitigates these risks, for instance, by exploring alternative financing options, establishing strong credit management practices, or implementing effective cash flow forecasting strategies. Companies get higher evaluation by diversifying revenue streams, building strong relationships with suppliers and lenders, and optimizing inventory management processes can help improve liquidity and reduce credit risk exposure in the long term.

Project Management Risks

Scope creep, resource risks, and technical risks are the essential part of project management evaluation. For instance, in a franchisee coffee shop, scope creep occurred when initial plan to offer only coffee and pastries expanded to include a full breakfast menu, requiring additional resources and time. Investors need to see clear franchise agreements, comprehensive training and support for franchisees, and stringent quality control measures in place to evaluate business accordingly.

Health Risks

Biological, environmental, and lifestyle factors have become increasingly important, especially after COVID-19. Investors need to see how companies manage risks in the workplace, including implementing measures to prevent the spread of infectious diseases (biological) or promoting employee wellness programs.

For instance, one of the UK-based retailers demonstrated vital components of an effective risk management strategy by prioritizing employee well-being through mental health support services and ergonomic workstations. The company’s public commitment to employee welfare not only underscores operational excellence but also enhances its reputation and company value.

Legal and Regulatory Risks

Compliance, litigation, and regulatory risks are important especially for investors evaluating a startup operating in different regions. As one of the recent examples, our client a European manufacturing company, operating in over 10 countries, greatly showcased how business ensures compliance with local laws and regulations across multiple jurisdictions, mitigating potential negative cases in various legal environments, and staying informed about regional regulatory changes.

Operational Risks

Companies encounter operational risks, process risks, supply chain risks, and human risks, which can become even more complex when, for example, venturing into new markets. These challenges may involve adapting to local practices, inefficiencies in new processes, disruptions in the supply chain, and uncertainties in human resources. For example, when one of our clients launched in Dubai, they had to localize their digital platform. By conducting market research and creating a user-friendly experience, a company established a strong presence, reducing operational risks. This approach boosted company evaluation by showing adaptability and effective management.

In supply chain risks, companies need to outline their contingency plans for negative scenarios, such as disruptions in logistics, shortages of raw materials, or relevant geopolitical tensions impacting tariffs. For example, some of the changes in EU taxes affecting tariffs lead to increased import costs and supply chain disruptions for companies importing goods from non-EU countries. By exploring alternative suppliers or diversifying supply sources an investor outlines the resilience and ability of the company to adapt to changing market conditions.

Addressing human risks, such as labor disputes or strikes affecting production and distribution processes, is important to ensure business continuity. What is your backup plan if the Chief Product Officer is leaving, and how might a new transition temporarily affect product development timelines? The signal for investors lies in how you monitor, review, and search for optimal scenarios in this case to preserve revenue streams.

Risks aren’t limited to financial matters alone and integrating risk management frameworks that also account for non-financial factors like environmental impact, social responsibility, and governance practices (known as ESG considerations) allows companies to adopt a more comprehensive approach. While many aspects are still in progress, one VP of a European bank recently shared that companies, compliant with ESG standards, receive the best lending terms.

Building Risk Management Process

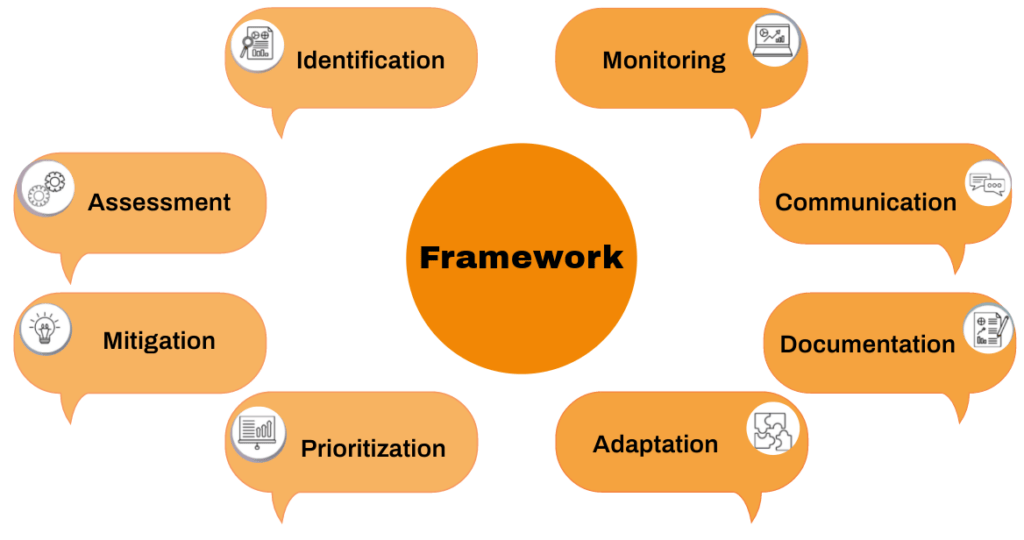

Here are some additional activities within the risk management process to establish a complete plan and showcase how risks will be managed by company wherever they appear:

Data-Driven Risk Analytics

It involves using data to comprehend and evaluate risks through actions with a map of relevant data sources, data patterns, and a potential impact of identified risks on the business. By getting informed predictions, investors gain insight into a company’s business potential and company evaluation. One of our clients, a pharmaceutical company, before launching a new product in Germany successfully addressed data-driven risk analytics with regulatory approval timelines, anticipating potential side effects, and assessing market entry.

Scenario Planning and Simulation

It involves creating hypothetical scenarios, such as market shifts, technological disruptions, regulatory changes, natural disasters, or unexpected competitor actions to showcase that company is prepared for potential risks. As one recent example, a tech startup developing a new mobile app for ridesharing used scenario planning to anticipate regulatory changes with research on potential regulatory shifts, engaging with industry experts and policymakers to gain insights, and developing contingency plans to demonstrate to investor, that company is ready to adapt the business model accordingly.

Dynamic Risk Management Frameworks

The most common practices include flexible strategies that can adapt to changing risks, such as emerging market trends, socio-economic shifts, geopolitical tensions, and organizational restructuring. This showcases a company’s ability to revise its plans and tactics according to the risk landscape and affects business evaluation.

For example, our client operating in countries with a low diversity index, created an inclusive onboarding design to mitigate risks arising from new regulations in some countries. Securing brand reputation from communicational crises, the company protected its evaluation level, maintaining a positive public image and fostering trust among stakeholders.

Collaborative Risk Ecosystems

This approach fosters teamwork across departments and stakeholders to identify and address risks collaboratively. For instance, a medical lab with a digital product utilized the COSO ERM (Committee of Sponsoring Organizations of the Treadway Commission Enterprise Risk Management) framework to identify and mitigate patient safety risks. Involving clinicians, administrators, and risk management professionals in decision-making processes, successfully reduced medical errors, enhanced patient care outcomes, and positively influenced the overall company assessment.

Behavioral Risk Management

It integrates an understanding of human behavior into risk management strategies, incorporating insights from psychology and behavioral economics to address human factors that influence risk outcomes within organizations, including cognitive biases, decision-making heuristics, social dynamics, and individual attitudes towards risk. As an example, a bank implements training programs to reduce the risk of clients falling victim to phishing scams. This proactive approach not only enhances security measures but also positively impacts company evaluation by demonstrating a commitment to protecting clients and mitigating potential risks.

Risk management integrates diverse components, customized to suit regional and industry nuances, but it must seamlessly align with company policies and operations. By integrating risk management monitoring and conducting regular reviews, companies can achieve higher evaluations and drive growth effectively.